Farmland offers guaranteed long-term

Our country’s backbone is agriculture. As a result, it’s no surprise that farmland is at the core of many profitable realty portfolios.

Farmland is a property option worth considering because of its excellent tax benefits and stability in the face of economic turmoil. Although stocks, residential units, and commercial property receive a lot of attention, they could be risky investments. While volatility isn’t necessarily a negative thing, farmland is increasingly becoming the preferred asset class for investors seeking long-term, stable, and predictable returns.

Let’s look at it more closely.

Is Investing in Farmland a Good Idea?

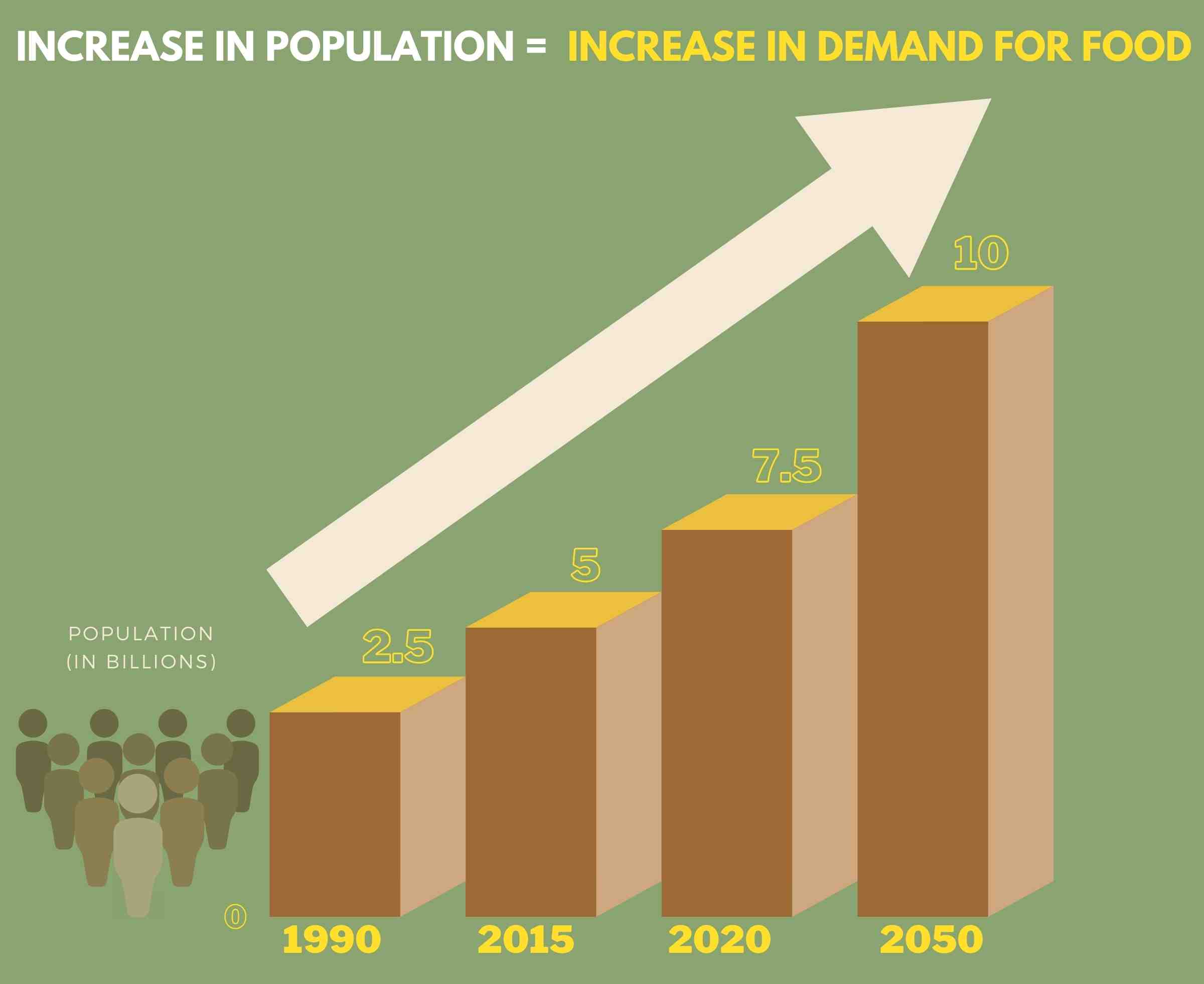

Farmland has the lowest volatility of all real estate assets over any period, making it a secure place to park money. One factor for this is a fundamental economic fact: people must eat. Agricultural land will continue to be a profitable investment because it should always be needed.

Farmland is a scarce resource, and there isn’t any more of it, to continue a subject of fundamental economics. It will always be worth something. That land will become even more productive as farming techniques improve. If you invest today, you will benefit from the increased productivity of scarce arable land. Because of the inherent link between the law of demand and supply and food production, a piece of land is unlikely to ever lose value. We expect agricultural land to outperform inflation in most parts of India. Farmland is, in fact, among the most inflation-resistant options that are available.

Farmland Return on Investment

If you’re on the edge about buying farmland, the guarantee of stability might be enough to persuade you to take the plunge. You, on the other hand, are an investor. You want more than simply security; you want your money to grow. So, “What earnings can I expect from farms?” you might be curious.

Both land value growth and income from the property itself can provide predictable returns to a wise investment.

Land value appreciation takes longer than other sorts of real estate (and practically all other types of investment). Crops and cattle take time to mature, and farmland, too, takes time to appreciate.

Investing in farmland is a long-term commitment. Before selling for a greater price, you’ll need to figure out how to add value to the property significantly. Direct income will provide you with profits on your investment in the short to medium term. This could occur in two forms: simple-rent from a landowner or direct agricultural operation. The type of revenue stream you choose is determined by your level of commitment.

To put it another way, if you don’t want to perform any agriculture yourself, you may still make money from the farm by subletting the land to a farm worker or farmer. We convert the operating income into a rental source of income, which can be paid upfront or as a percentage of the farm’s production value. When you add in the increase in land value during the same time, the profits start to add up.

Investing in farmland Has Tax Benefits:

Taxes are something that every investor thinks about, thus the tax advantages of farms are worth mentioning. Agricultural property owners have a unique opportunity to reduce their tax liability by claiming amortization on specific crops. You can also create or make renovations to the property, just like any other business, which are expenditures that can be reduced from your gross revenue. Farmland enjoys helpful taxation rates in all state governments because of policies promoting agriculture. I may even designate your property a preservation trust. Protecting the property as farmland will bring much more tax benefits in every state.

How to Buy in Farmland

If you haven’t noticed before, farming is a unique form of investment. Keep two crucial things in mind. First, it demands severe money management to invest. And second, investors require a fundamental grasp of the type of farms they want to invest in. Another possibility to explore is to passively take part in part of the activities of a farm. All it needs is a little planning and imagination as you search to invest. However, you don’t need to understand anything about farming crops to be a farm owner. However, it helps to conduct some investigation so you can correctly balance risk versus the possibility for returns.

The Fact Of the matter

All the tax benefits, together with financial potential, cumulatively offer a powerful case for engaging in farming. Like other types of real estate, farms have their idiosyncrasies. Investigate the land, get adequate financing, and estimate future potential expansion.

The simple truth is agricultural property is a steady, potentially rewarding asset in all economic conditions, so don’t underestimate it when you’re trying to add another component to your investment portfolio.

If you are looking for guaranteed- long-term returns do not hesitate to invest your savings in managed agricultural land by Ackerland Lake Bliss. Ackerland is one of the Top Farmland asset management company in Bangalore provides you to own a farm that suits your needs.